Revisiting the Demographic Event Horizon as Financial Nihilism Explodes

A discussion of the current speculation and market fragility along with a heap of charts

As the current onslaught of frenzied, manic speculation continues apace, many are wondering — myself included — if we have finally achieved what I first referenced as “Max Stupid” in an August 2022 thread where I described the All Clear Echo. After all, it’s not like Max Stupid is new. If anything, it seems extremely long in the tooth. Over 18 months ago in May 2023, I first flagged AI as the tech subset likely to be the focus of the All Clear Echo, like fiber optic/routers during the dotcom’s Echo in 3Q 2000. I also mentioned that it would run much farther and longer than we could imagine. NVDA was $300 then ($30 split adjusted today), and even I could not imagine we would rally 5x from that point. As the months passed and the rally rolled on amidst a cacophony of recession calls, some managers got the joke (to their credit), and rushed in with style drift on full display. By June, NVDA CEO Tim Jensen was signing a woman’s breasts at a tech conference, and this centimillionaire was back from a 2-year disappearance and captivating the world on a Friday afternoon:

Bitcoin was $69k then. In the six months since, and especially in the last few weeks, the examples of Max Stupid have come so fast and furious it’s become hard to keep up:

A kid sits on the toilet and refuses to get off until his Shitcoin breaches $50mn in value.

A billionaire CEO who was charged with violating securities laws and accounting rules after the 2000 tech bubble goes on CNBC with this headspinning insanity encouraging retail buyers to purchase his absurdly overvalued stock (where ironically he says the quiet part out loud and basically calling his shareholders idiots for buying a dollar for $3 …that’s what “we sell a dollar for three dolllars” means people), while Wall Street in its inventiveness of repackaging leverage goes full tilt (described here and here).

An internet sensation built on a sex joke launches a memecoin that reaches $500mn in market value before crashing, with initial analysis suggesting that over $50mn was cashed out (I would say fraudulently, but what does that word even mean anymore).

Fartcoin trades over $200mn in market value.

…Meanwhile Reddit personal finance message boards show spousal concerns (I confess that “hot air rises” is a timeless retort):

A few months ago when I wrote Staying Close to the Casino, I did not expect the gambling to broaden out as it has, and speculation has no longer been limited to just NVDA or crypto. With all these meme examples coming fast and furious (reminiscent of the crazy 2021 episode), the broader call volume on US exchanges has simply exploded (pink=20dma, green=50 dma):

Source: PauloMacro via Bloomberg

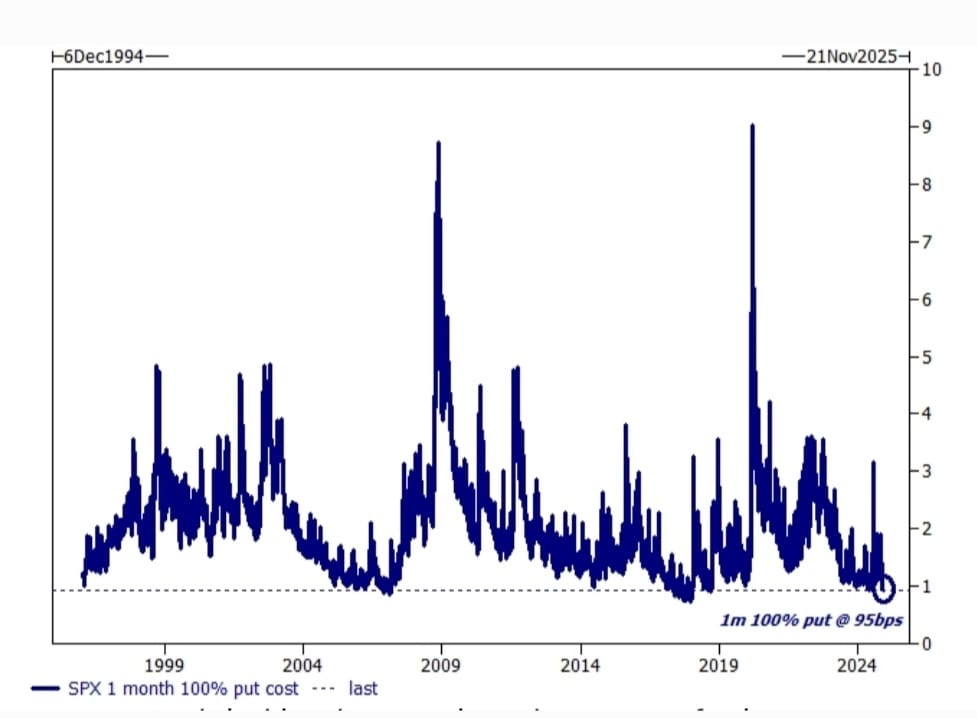

And in the meantime investors have become so convinced the market does not require insurance that the cost of an ATM S&P put is now 95bps for the next 30 days — pretty much as cheap as it gets in 2007 and 2018, only question is how long we stay there while people get up and dance before the next risk rupture:

Source: Goldman Sachs

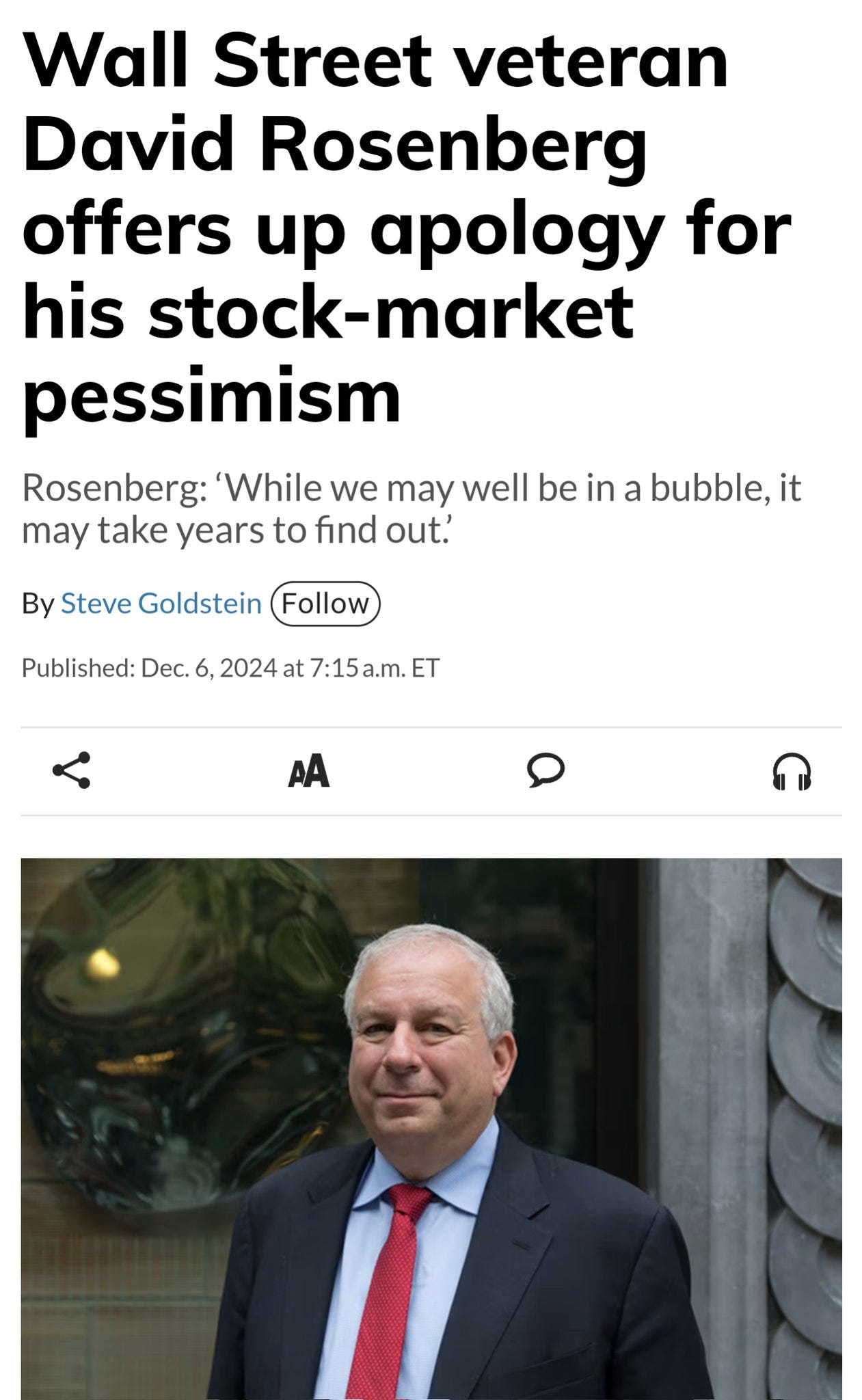

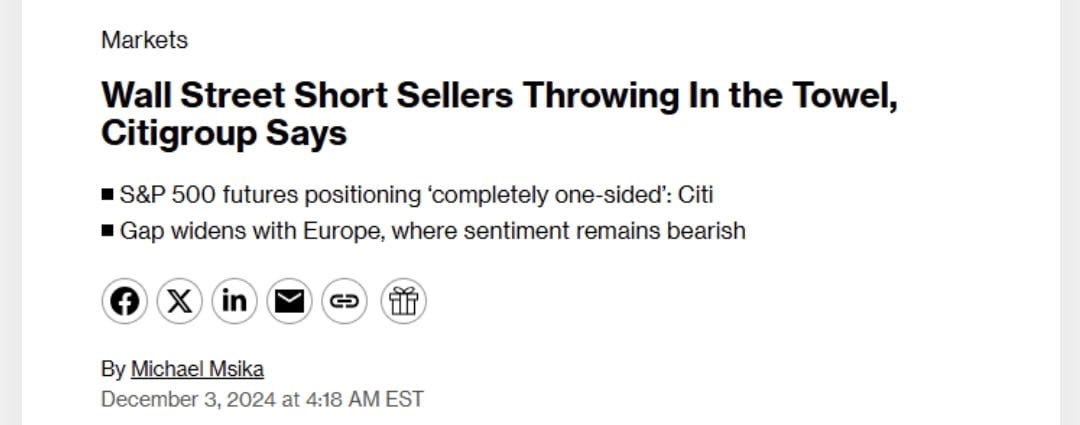

While gambling takes on a new dimension, those who have attempted to resist joining the crowd have been forced by peer pressure or career risk to capitulate and clear their heads in a literal epidemic of towel-throwing bears. Here’s an overview of a few just from this week:

A common refrain of my phone calls with friends over the last few days has involved me asking the following question: “Where is the money for this coming from? I understood 2020-21 — they locked everybody down and handed out a ton of free money to go gamble. But where is all this money coming from now? I don’t get the source of all this ‘liquidity.’”

Then I stumbled over this tweet from Demetri Kofinas, and it all clicked: