Staying Close to the Casino

Thinking more effectively and broadly about what the market has become

Last night a reader asked about platinum on the Substack chat, specifically whether platinum could do a ‘catchup’ to gold. After all, platinum is cheap to gold based on its historical ratio, is much scarcer than gold, with an outlook for deficits and potential fundamental catalysts. But while these points may help construct a Narrative of Value around platinum, they don’t really address the meat of the question, which is really “should it move now because gold is moving and platinum has not kept up” — and this got me to thinking more broadly about the casino that the markets have become.

A quick aside here: This is not a note on platinum. I will write on that another time. I have a self-imposed timeout from doing anything in platinum until December at the earliest, and only because so many friends whom I highly respect all seemed to get hip to platinum around the same time back in the spring. This is not a knock at them — I count some of them among my closest friends in the markets, and their analysis is on point — but I try really hard to resist leaning into anything with a lot of visibility, especially when an idea seems to catch fire quickly and yet price doesn’t react. So I did the work, and told myself that I would sit tight for 6 months. This is the only way I know how to try to protect myself from the trap of being way too early (same as wrong, and this costs mental capital), and stay out of stuff like uranium from 2016-2020. Plus I haven’t felt like I’ve had a good read yet on positioning and expression until recently. Again — we’ll discuss platinum another time.

Back in June, my buddy

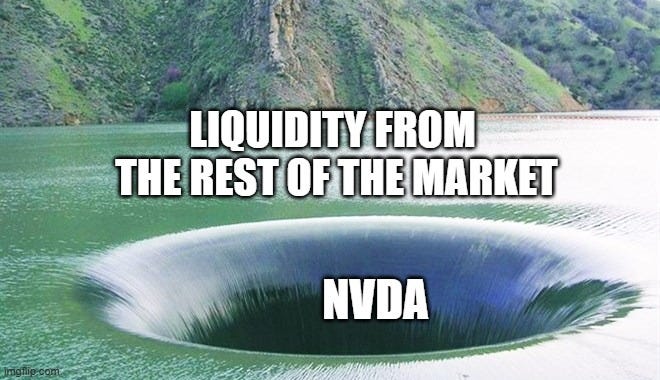

wrote a well-timed piece called What If on the resurgent possibility of what I have taken to calling the Great Rotation Narrative… namely, the idea of a massive capital shift out of US / Growth / Megacaps / Defensives / Tech → RoW-EM / Value / SMidcaps / Cyclicals / Commodities. In his note, Shrub visualized Nvidia as a giant liquidity whirlpool that was sucking the oxygen out of everything else in the market, which he captured with this image perfectly……and he asked what happens if that flips?

In my mind, NVDA (and US Mag7 more generally) have acted like a giant capacitor for the world’s excess savings and liquidity (in tandem with USTs until recently), acting as the world’s great parking spot for big money in a meme I refer to as US Exceptionalism. The electric charge builds and builds as capital gets pulled into the capacitor. One day it will release as all energy does, but NVDA at nearly $4 trillion is simply SO BIG that there is no way for any one single spot to catch it. So the discharge is going to look like one of those “Tesla Balls” (no pun intended), where NVDA and USTs are the center mass and discharge liquidity in a bunch of different directions at once…to stuff like Emerging Asia, LatAm equities, metals — basically markets that are far too small to handle the size, bringing to mind the old “Elephants through a keyhole” idea:

Plasma Ball for sale on Amazon.com

This notion further inspired an idea that goes to the heart of the “1970s Nifty Fifty” comparisons today, and answers the original question about a platinum ‘catchup’ to gold, namely: