When I think about trading, I am always impressed by how someone’s motivations to own or avoid an asset class can vary greatly depending on where one sits.

For an example of what I mean, I used to highlight back in the 2010s that gold could not be in a true bull market until all currencies were getting in on the action. To wit, gold had a mediocre “lost decade” (Jan2010 to Dec2019), featuring a 3% annualized return from start to finish, with an intervening 4-year bear market in 2011-2015 and a -45% drawdown. By the end of the decade, gold holders were still -20% lower than the 2011 peak… simply brutal:

Source: PauloMacro via Bloomberg

If you were Japanese, gold delivered a somewhat better decade of +65% (+5.0% annualized), with a max drawdown of -25% in 2013. Sure, you chopped wood for 7 years, but you still went out on the highs…not great, but not terrible either:

Source: PauloMacro via Bloomberg

Of course, these were low consumer inflation periods in developed markets (with some pretty epic Fed-fueled asset inflation in the US…go team!). Wander over to Brazil, and you lived in a very different gold market — a +220% return (+12.3% annualized) with a max -28% drawdown in 2012-13 and another -25% in 2016:

Source: PauloMacro via Bloomberg

Depending on where you sat, you thought about gold quite differently.

Fast forward to today. My good buddy

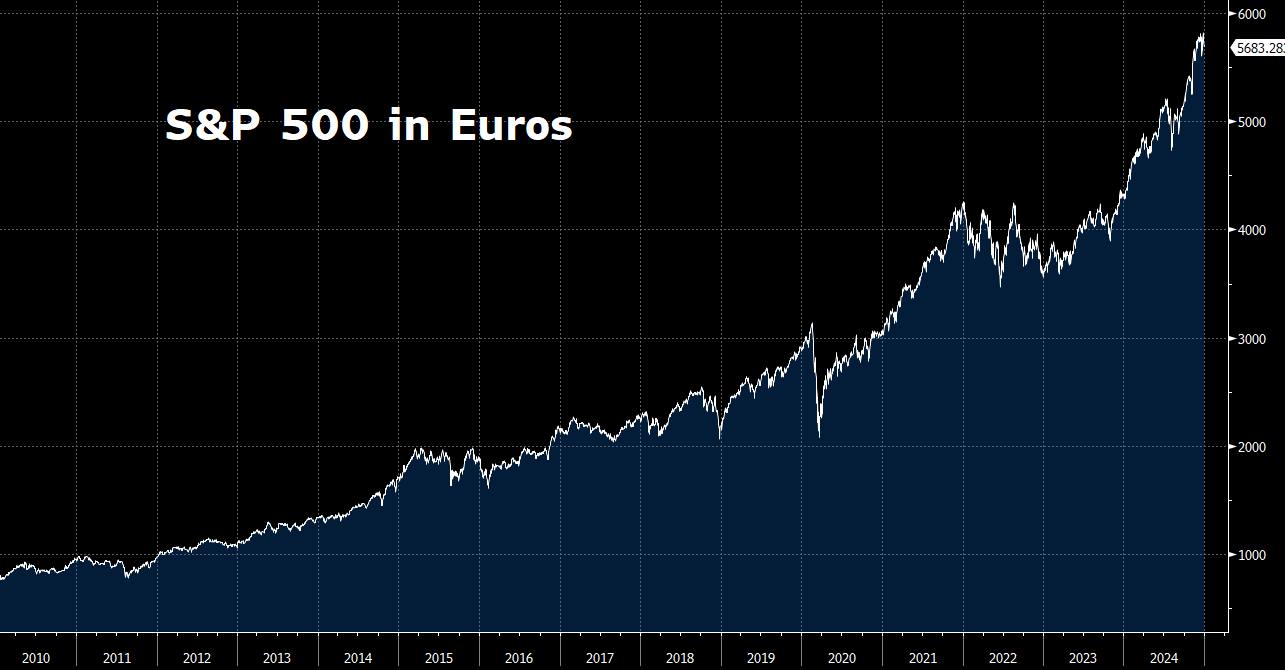

has characterized the quintessential German pension CIO as “Klaus” (I recently joked with him that we have to add Olaf, Thor, and François to the list). For the 15 years from the GFC aftermath in 2009 to Trump’s second election, Klaus’s job was both easy and incredibly profitable: own the S&P 500 without hedging the currency. Those who knew me back in 2017-19 remember me as a broken record saying how this was the single most important chart in the world:Source: PauloMacro via Bloomberg

Imagine earning +636%, or +14.3% annually … for 15 years. Factor in dividends, and Klaus got a +859% total return, or +16.3% annually in Euros! And the worst he had to endure was a brief, scary -33% drawdown during Covid (hey, that wasn’t his fault — who could have seen that coming?), and three relatively painless -18% corrections in 2015-16 (China slowdown), 4Q18 (Fed hikes, quickly remedied), and 2022-23 (Fed hikes, eventually remedied).

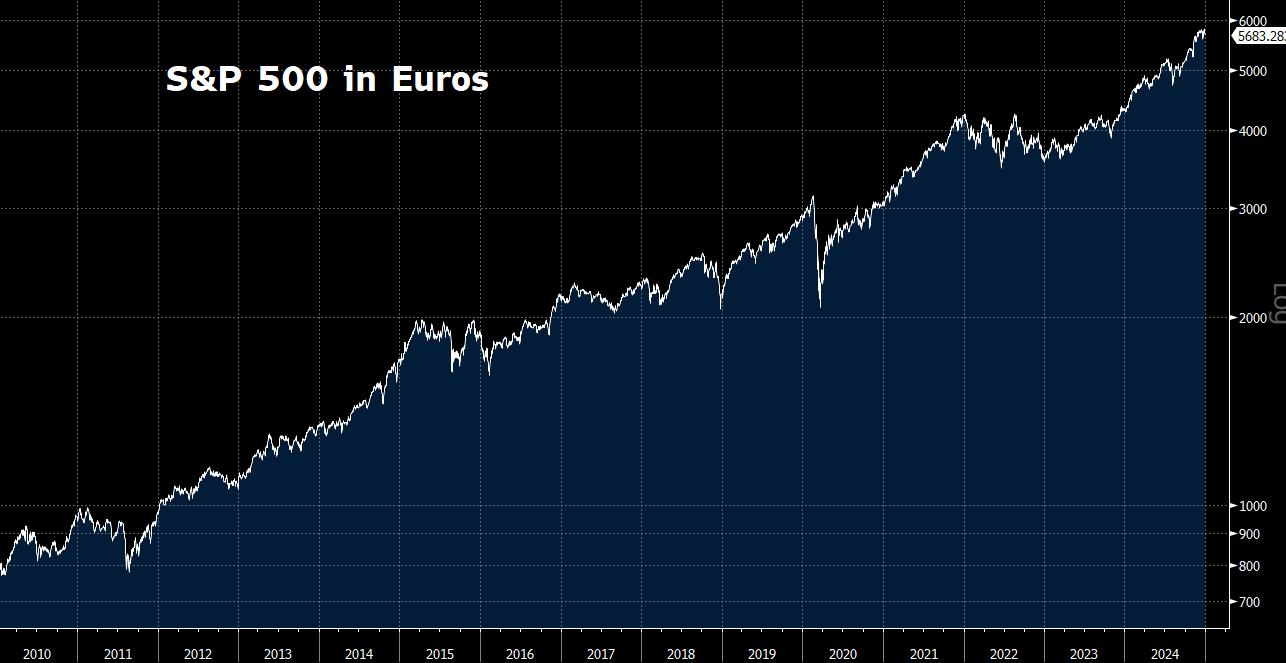

The same chart in logarithmic form shows the 15-year ride of a lifetime in nearly a straight line (funny, if you squint and take out the Covid crash, it almost looks like Madoff’s returns):

Source: PauloMacro via Bloomberg

Well, it’s been one helluva ride for Klaus, Olaf, Thor, and Francois…

During this new stage of the depression, the refugee gold and the foreign government reserve deposits were constantly driven by fear hither and yon over the world. We were to see currencies demoralized and governments embarrassed as fear drove the gold from one country to another. In fact, there was a mass of gold and short-term credit which behaved like a loose cannon on the deck of the world in a tempest-tossed era.

— The Memoirs of Herbert Hoover, The Great Depression 1929-1941, pg 67

So where do things stand now?